Use the form below to make a change request.

Suppliers

Welcome to our Supplier Portal—where you can find resources on making a change request to your business partner account.

Supplier Change Request

If you have any questions after exploring all supplier help options, feel free to contact us at the following email: AP@huntoil.com

How to Submit a Change Request

REMITTANCE EMAIL CHANGE:

- Select ‘Remittance Email Change’.

- Enter the old email address.

- Enter the new email address.

- Provide the following information:

- EIN/TIN

- Vendor account number

- Requestor’s full name

- Requestor’s email address

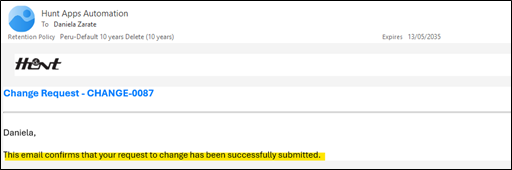

- Once submitted, you will receive a confirmation email like the one shown below.

ADDRESS CHANGE (W-9 is Required):

- Select ‘Address Change (Required W-9)’.

- Enter the old address.

- Enter the new address.

- Provide the following information:

- EIN/TIN

- Vendor account number

- Requestor’s full name

- Requestor’s email address.

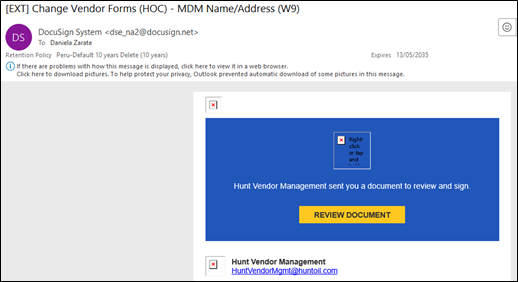

- A DocuSign package with a W-9 form will be sent to the registered email address. You will receive two emails:

- The first is a confirmation of your request.

- The second contains the DocuSign package.

Important: Complete the W-9 form using the link provided in the second email.

BANK ACCOUNT CHANGE (W-9 and ACH Form Required):

- Select ‘Bank Account Change (Required W-9/ACH Form)’.

- Provide the following information:

- EIN/TIN

- Vendor account number

- Requestor’s full name

- Requestor’s email address

- A DocuSign package with a W-9 and ACH form will be sent to the registered email address. You will receive two emails:

- The first is a confirmation of your request.

- The second contains the DocuSign package.

Important: Complete the forms using the link provided in the second email.

BUSINESS NAME CHANGE (W-9 Required):

- Select ‘Business Name Change (Required W-9)’.

- Provide the following information:

- Your company name

- Your Hunt contact name

- Hunt contact email address

- Also provide:

- EIN/TIN

- Vendor account number

- Requestor’s full name

- Requestor’s email address

- A DocuSign package with a W-9 form will be sent to the registered email address.

You will receive two emails:- The first is a confirmation of your request.

- The second contains the DocuSign package.

Important: Complete the W-9 form using the link provided in the second email.

EIN CHANGE (New Vendor Setup Required):

- Select ‘EIN Change (Required New Vendor Setup)’.

- Provide the following information:

- Your company name

- Your Hunt contact name

- Hunt contact email address

- Also provide:

- EIN/TIN

- Vendor account number

- Requestor’s full name

- Requestor’s email address

- A DocuSign package with a W-9 form will be sent to the registered email address. You will receive two emails:

- The first is a confirmation of your request.

- The second contains the DocuSign package.

Important: Complete the W-9 form using the link provided in the second email.

OPENINVOICE ENABLEMENT/VISIBILITY IN OPENINVOICE:

- Select ‘OpenInvoice Enablement or See Hunt in OpenInvoice’.

- Provide the following information:

- Your company name

- Your Hunt contact name

- Hunt contact email address

- Also provide:

- EIN/TIN

- Vendor account number

- Requestor’s full name

- Requestor’s email address

Response Emails

You will receive one or both of the following email responses when following the steps above so please monitor your email.

Confirmation Email

Second Docusign Email

Supplier FAQs

WHERE CAN I FIND THE LINK TO ACCESS THE APP?

-

- To submit an change requests, please visit: HUNT Business Partners Change Request.

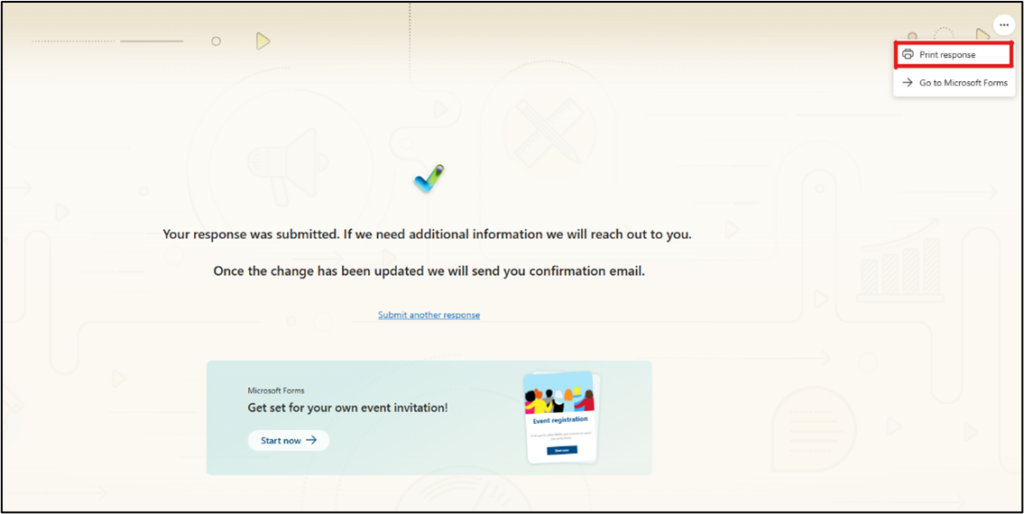

Can I print or save my request?

Yes, you can print your submission request.

Once you complete the form, you will be redirected to a confirmation page (as shown below).

Click on the three-dot icon and select ‘Print response’.

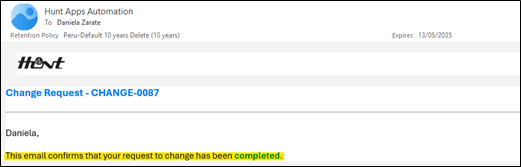

How do I know if the change has been completed?

The MDM team will review and process your request. Once it has been approved, you will receive a confirmation email like the one shown below.

What happens if the EIN does not match IRS records?

For requests that require a W-9 form, the system performs an automatic validation with the IRS to ensure that the name entered in Box 1 matches the TIN provided.

If the IRS cannot validate your company, you will receive an email notification (as shown below).

In that case, you must submit a new request with the corrected information.